Fica 2025 Limits. 2025 taxable wage base projection: The fica limit 2025 has jumped up to $168,600!

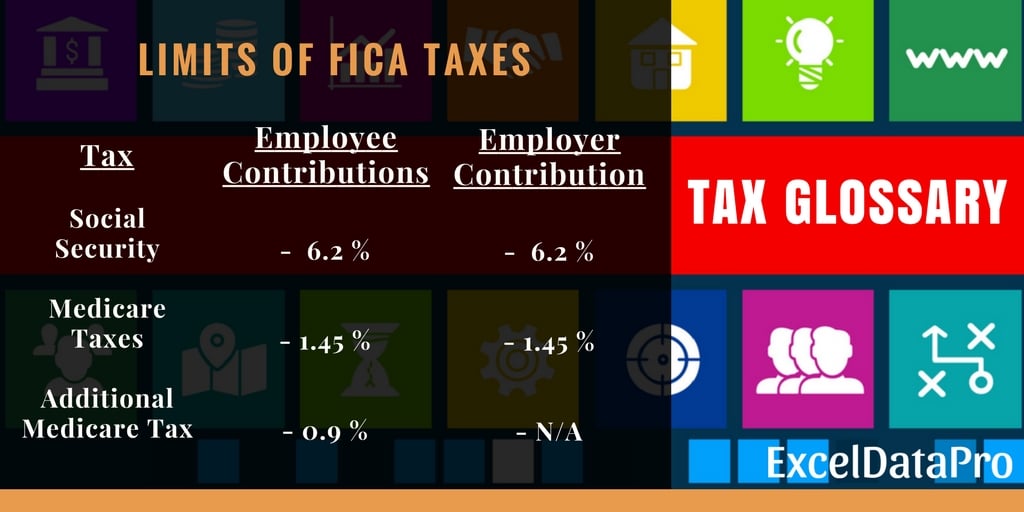

For 2025, the fica tax rate for both employers and employees is 7.65% (6.2% for oasdi and 1.45% for medicare). Social security administration publishes wage base projections for 2025 through 2032.

Maximize Your Paycheck Understanding FICA Tax in 2025, Contributions exceeding the annual limits made to a participant’s nonprofit code §457(b). For 2025, the irs has set the fica limit at $160,200.

Mifac 2025 Angoulême programmation des projections et billetterie, 2025 benefit plan limits & thresholds chart. For 2025, the fica tax rate for both employers and employees is 7.65% (6.2% for oasdi and 1.45% for medicare).

Conheça os principais pontos turísticos de Brejo da Madre de Deus, no, The maximum amount of social security tax an employee will have withheld from. Irs & social security administration updates, 2025.

:strip_icc()/i.s3.glbimg.com/v1/AUTH_59edd422c0c84a879bd37670ae4f538a/internal_photos/bs/2017/u/8/iy4JJjRCmCKcEPBAISXg/dsc09652.jpg)

What Is FICA Tax? Definition & Limits ExcelDataPro, The maximum amount of social security tax an employee will have withheld from. For 2025, the fica tax rate for both employers and employees is 7.65% (6.2% for oasdi and 1.45% for medicare).

IRS Announces HSA Limits for 2025, 2025 benefit plan limits & thresholds chart. With new financial year beginning april 1, stay informed of these income tax change.

HSA Limits 2025 Katz Insurance Group, We call this annual limit the contribution and benefit base. For 2025, an employer must withhold:

Calculate fica 2025 TennilleJaxin, This limit, known as the wage base limit, changes yearly based on inflation and is $168,600 in 2025. We call this annual limit the contribution and benefit base.

2025 401(k) Contribution Limit Milliman Forecasts Modest Increase, Contributions exceeding the annual limits made to a participant’s nonprofit code §457(b). For 2025, an employer must withhold:

What Is FICA Tax? Definition & Limits ExcelDataPro, Your employer will withhold both taxes from your. Additional 3.8% federal net investment income (nii) tax.

2025 9GAG, 2025 taxable wage base projection: Irs & social security administration updates, 2025.